(e) Standing order payment of $1,500 (for rent) also fails to appear in the cash book. Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist. Therefore, such adjustment procedures help in determining the balance as per the bank that will go into the balance sheet. Kevin has been writing and creating personal finance and travel content for over six years. He is the founder of the award-winning blog, Family Money Adventure, and host of the Family Money Adventure Show podcast.

Starting with an incorrect opening balance:

Common sources include deposits in transit that have not yet been deposited in your bank account, as well as bank fees that have been withdrawn by your bank but may have been missed in your company records. The statement itemizes the cash and other deposits made into the checking account of the business, as well as any expenses paid by the business. This includes everything from wages and salaries paid to employees to business purchases like equipment and materials. Bank statements also show expenses that may not have been included in financial statements, such as bank fees for account services. The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement. After fee and interest adjustments are made, the book balance should equal the ending balance of the bank account.

But this is not the case as the bank does not clear an NFS check, and as a result, the cash on hand balance gets reduced. A reconciliation statement refers to the banking summary prepared by the banks to list down the bank’s account balances and compare the same with their internal records. understanding real vs. nominal interest rates The purpose behind preparing these statements is to detect the differences between the entries of the two statements and work on rectifying them. By avoiding these common errors, you can ensure the accuracy of your organization’s financial records, make informed business decisions, and reduce the risk of financial issues. Regular reconciliation and review of financial records can help identify and resolve errors promptly, reducing the risk of financial issues.

Get in Touch With a Financial Advisor

After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. In addition to this, the reconciliation process also helps keep track the occurrence of fraud, which can help you control your business’ cash receipts and payments. If you find any bank adjustments, record them in your personal records and adjust the balance accordingly. The above diagrammatic representation is the easiest way to understand what is to be added and deducted.

Review: What are bank reconciliations?

- These outstanding deposits must be deducted from the balance, as per the cash book, in the bank reconciliation statement.

- For example, you wrote a check for $32, but you recorded it as $23 in your accounting software.

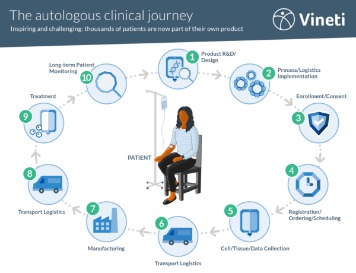

- Reconciliation of bank statements is the process of comparing the transactions recorded in the company’s accounting records with the transactions listed on the bank statement.

- Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services.

- This announcement came following its acquisition of ClearRec and rebranding itself as OpenGovBank Reconciliation.

- As a small business, you may find yourself paying vendors and creditors by issuing check payments.

Cross-checking bank statements with the balance sheet at least once every month during the closing process is necessary. If the business has a high volume of transactions, reconciliations should be done more frequently. The frequency of reconciling bank statements depends on the size and complexity of the business and its transaction volume. For larger companies with a high volume of transactions, it’s advisable difference between debtors and creditors to reconcile bank statements daily to ensure that any discrepancies or errors are promptly identified and corrected..

Financial accuracy is also important for ensuring that all payments have been fulfilled and orders have been completed. Go through both statements and highlight any transactions that appear on only one side. Note that transactions may take a few days to clear, so the transaction date in your financial records may how to convert accrual basis to cash basis accounting not precisely match the date on your bank statement. Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000.

They are helpful when reconciling accounts to print statements, clearing errors, etc. They can also be helpful when reconciling accounts for pulling reports.Another example would be where you deposit cash, but the teller doesn’t post it correctly. You have to go back and compare your records with the bank’s to try and figure out what went wrong so you can correct your records to match the banks. A bank reconciliation statement is only a statement prepared to stay abreast with the bank statement; it is not in itself an accounting record, nor is it part of the double entry system. Bank reconciliation statements safeguard against fraud in recording banking transactions. To quickly identify and address errors, reconciling bank statements should be done by companies or individuals at least monthly.

The reconciliation of bank statements is a critical step in maintaining accurate financial records for any business, ensuring that the company’s accounting records are up-to-date and accurate. By reconciling bank statements regularly, business owners can identify any missing or duplicate transactions, bank errors, or fraudulent activity early on, before they pose significant challenges. A bank reconciliation is an essential process for ensuring that your company’s financial statements match the available cash in your business bank account. Performing regular bank reconciliations helps you stay on top of cash flow, keep organized records for tax season, and minimize the risk of fraud and theft. We’ll explore the definition of bank reconciliation, why it’s important, and a step-by-step process for performing bank reconciliations. We’ll also look at common sources of discrepancies between financial statements and bank statements to help you identify fraud risks and errors.

He has been quoted by publications like Readers Digest and The Wall Street Journal. Kevin’s work has been featured in Bankrate, Credible, CreditCards.com, Fox Money, LendingTree, MarketWatch, Newsweek, New York Post, Time, ValuePenguin and USA Today. We offer reconciliation reports, discrepancy identification, and live accountants to work with for ease and confidence when closing your books.

You need to determine the underlying reasons responsible for any mismatch between balance as per cash book and passbook before you record such changes in your books of accounts. When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference. One of the primary reasons this happens is due to the time delay in recording the transactions of either payments or receipts. Likewise, ‘credit balance as per cash book’ is the same as ‘debit balance as per passbook’ means the withdrawals made by a company from a bank account exceed deposits made.

0 Comments